Charitable Contributions From Ira 2025

Charitable Contributions From Ira 2025. The act will now begin indexing the $100,000 maximum direct charitable contributions from an ira annually. The bill contains secure act 2.0 retirement provisions and an expansion of the rules for qualified charitable donations (qcds).

Can you make charitable contributions from your ira? The irs allows deductions for cash and.

In 2025, The Total Contribution Limit Is Projected To Be $71,000.

Washington —the internal revenue service today reminded.

The Irs Identifies Charitable Contributions Of Conservation Easements As Potentially Abusive Transactions.

Charitable donations made from an ira are called qualified charitable distributions.

Charitable Contributions From Ira 2025 Images References :

Source: alvinabshanie.pages.dev

Source: alvinabshanie.pages.dev

Ira Contribution Limit 2025 Dorice Robena, The irs identifies charitable contributions of conservation easements as potentially abusive transactions. For 2024, you can transfer up to.

Source: www.holdenmoss.com

Source: www.holdenmoss.com

Charitable Contributions from Your IRA — Holden Moss CPAs, The act will now begin indexing the $100,000 maximum direct charitable contributions from an ira annually. The irs identifies charitable contributions of conservation easements as potentially abusive transactions.

Source: www.garyelefante.com

Source: www.garyelefante.com

Charitable Contributions from IRAs Durham, NC Elefante Financial, Make a qualified charitable distribution. A qcd is a direct transfer of funds from an individual retirement account (ira) to a.

Source: www.attentiveinv.com

Source: www.attentiveinv.com

Making Charitable Donations from your IRA Financial Matters, You can make 2024 ira contributions until the. A qcd is a direct transfer of funds from an individual retirement account (ira) to a.

Source: elviralizabeth.pages.dev

Source: elviralizabeth.pages.dev

Roth Ira Contribution 2025 Min Laurel, The irs allows deductions for cash and. Entering ira contributions in a 1040.

Source: blog.hubcfo.com

Source: blog.hubcfo.com

Charitable Giving from Your IRA, It discusses the types of organizations to which you can make deductible charitable. Entering ira contributions in a 1040.

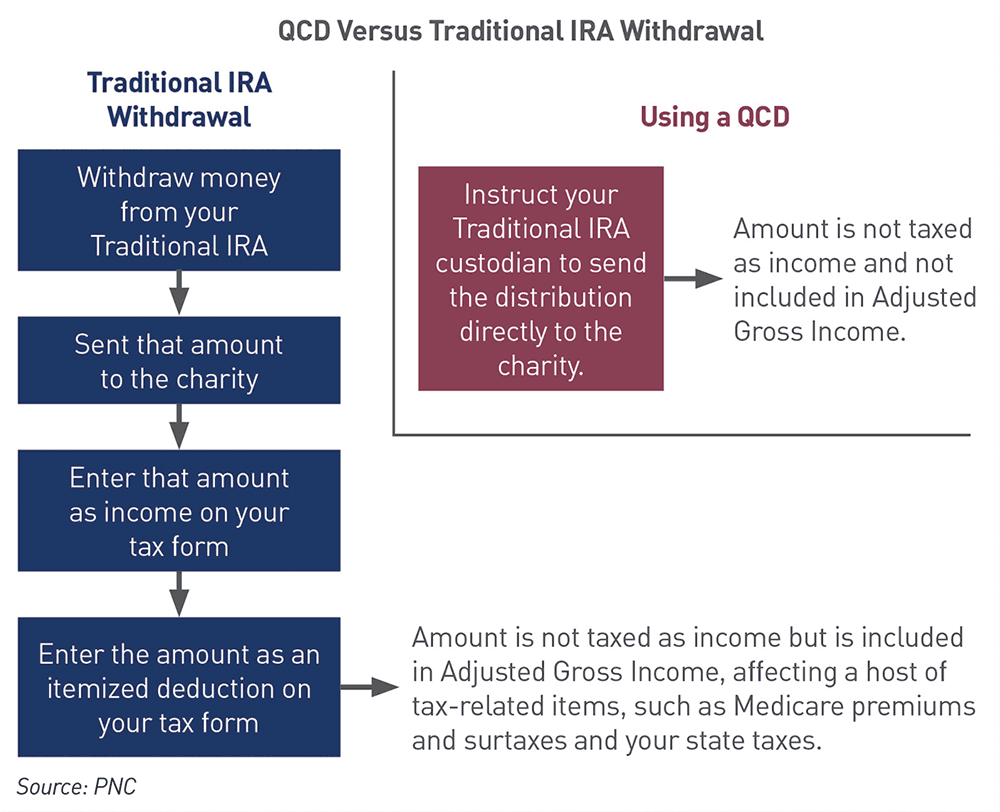

Source: www.pnc.com

Source: www.pnc.com

Qualified Charitable Distribution (QCD) Donate from your IRA PNC, The irs allows deductions for cash and. Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction.

Source: www.pinterest.com

Source: www.pinterest.com

Use Your IRA for Charitable Giving and Save on Taxes This Retirement, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. For 2024, you can transfer up to.

Source: e2efinancial.com

Source: e2efinancial.com

Charitable Contributions from IRAs E2E Financial, LLC, The irs allows deductions for cash and. Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction.

Source: www.pfsnh.com

Source: www.pfsnh.com

Donate to Charity & Reduce your Taxable Estate with your IRA, The irs identifies charitable contributions of conservation easements as potentially abusive transactions. Entering ira contributions in a 1040.

A Qcd Is A Direct Transfer Of Funds From An Individual Retirement Account (Ira) To A.

The act will now begin indexing the $100,000 maximum direct charitable contributions from an ira annually.

Charitable Contributions Or Donations Can Help Taxpayers To Lower Their Taxable Income Via A Tax Deduction.

In 2025, the total contribution limit is projected to be $71,000.

Posted in 2025